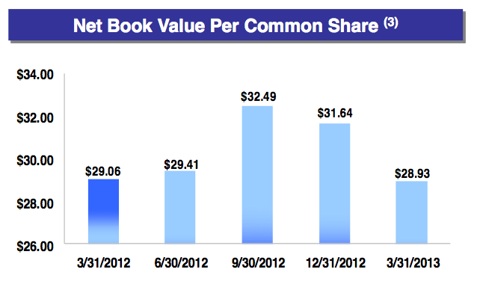

Last week, American Capital Agency Corp. (AGNC), the second-largest mortgage real estate investment trust, or mREIT, declined after reporting first quarter earnings that included an 8.6 percent drop in its book value at the end of Q1 of 2012 compared to the end Q4 of 2012. The mREIT's book value declined by $2.71 to $28.93 per share. This is the second consecutive quarter where AGNC's book value declined after increasing substantially in mid-2012. See a recent book value performance chart for AGNC.

AGNC's President and Chief Investment Officer, Gary Kain, noted during the company's conference call that the securities that it acquired in order to protect itself from refinancing and prepayment risk performed "considerably worse than we anticipated." In the second quarter of 2012, Kain noted that AGNC had "repositioned the portfolio during the quarter into lower coupon MBS and lower loan balance and HARP securities, which are less susceptible to prepayment risk, reducing the impact of the decline in long-term interest rates on the Company's prepayment forecast."

Investments in Real Property is a complicated type of business because of the competetion in the market. We need to make sure that we market our business well enough to be well known. Keep communication with our friends and possible clients to be able to spread the word of our investment.

ReplyDeletehttp://real-estate-investments-australia101.blogspot.com/2013/10/property-investments.html